By Mario Mckenzie, Partner, and Raquel Castro, Principal, CliftonLarsonAllen

Even the best positioned senior living and care providers can face financial challenges that — in hindsight — could have been spotted early and possibly prevented. We’ve outlined some ideas to help your board and management teams focus on the financial wellness of your organization and identify early indicators of financial risk.

GOVERNANCE WELLNESS CHECKLIST: MARKET POSITIONING

Are you well-positioned in your market space?

One of the biggest predictors of financial decline is the inability to remain marketable. We are in an era of significantly increased competition from alternative products and services, and during the last decade many providers have struggled to grow while target demographics have grown significantly.

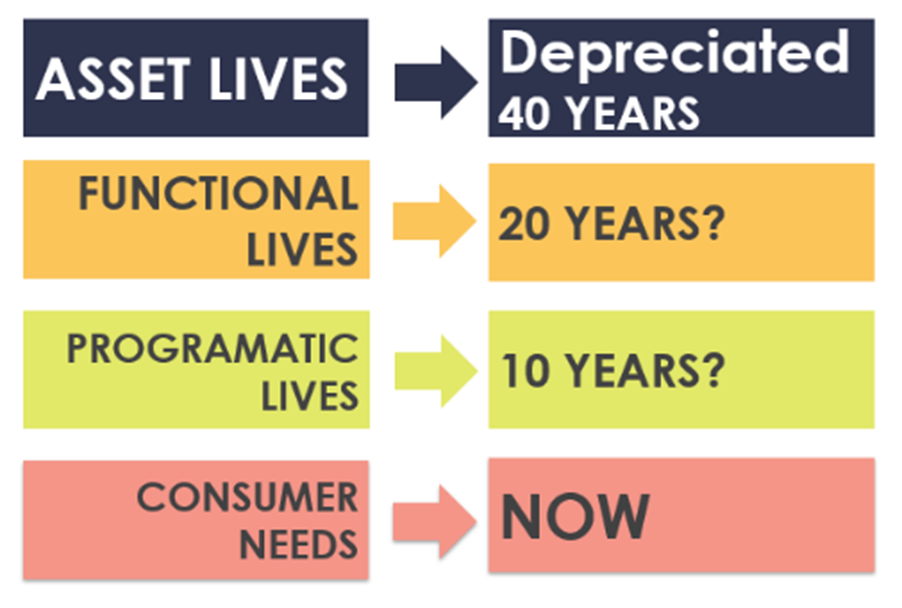

A significant risk to your market position is the belief that your market and consumers are static. As noted in this graphic, many buildings were built for long lives, whereas functional and programmatic needs require change much quicker. Structural challenges are also an issue: if you have a predominance of nursing beds, the consumer does not really “choose” to move in — and innovation and differentiation is dictated by regulatory guidelines. If you are heavily weighted with independent living, then a consumer must choose to move, for a vast number of individual reasons, or stay home (the preferred product for aging).

How do you gauge market positioning? Boards must evaluate three elements: physical assets, pricing, and services — all of which require financial resources to modify.

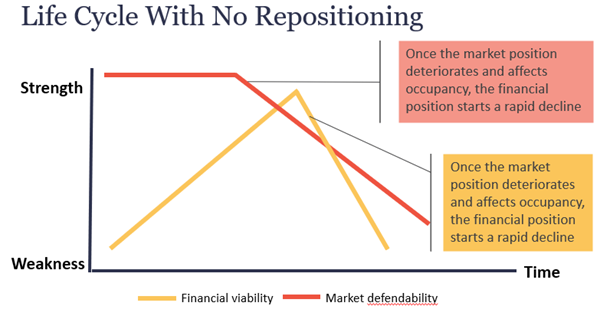

The first symptom of a fundamental problem is a period of declining census, or price compression (lowering or flattening of pricing to maintain census). This is generally followed by financial erosion, then financial stress. Aligning execution of your organizational mission by making timely, business-oriented decisions can help generate the necessary resources to achieve your vision.

GOVERNANCE WELLNESS CHECKLIST: FINANCIAL VIABILITY

Can you invest in yourself from a position of financial strength?

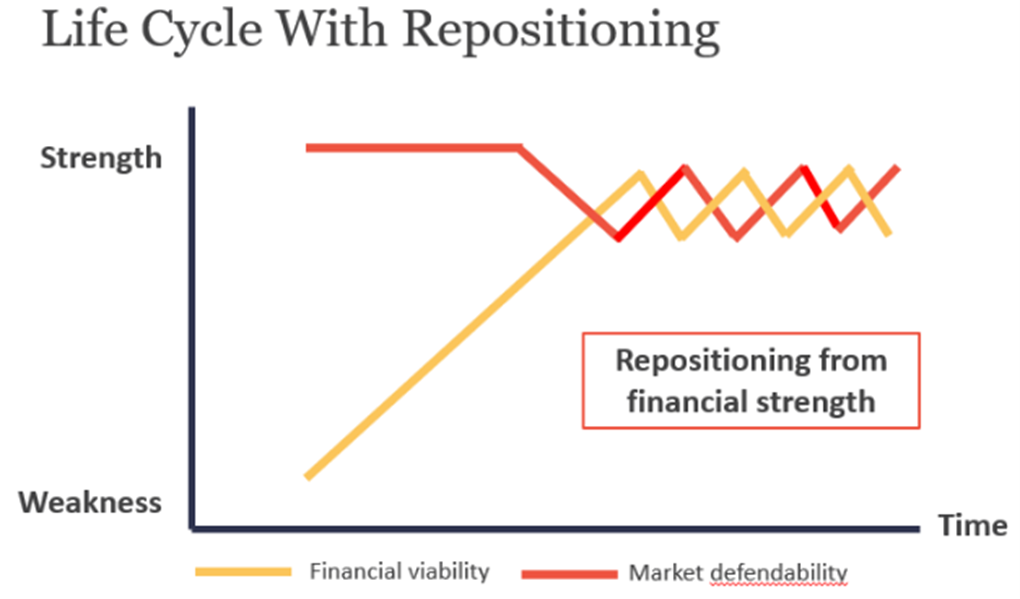

A facility that has not reinvested in itself or created enough physical or programmatic change to stay current with the next generation of consumer may significantly increase the likelihood of occupancy declines. As shown in the graphic, the time to reposition is from a state of financial strength, before the emergence of financial challenges or declining occupancy.

Board members should allow enough financial capacity for strategic market repositioning of your facility, while acting with agility and enabling a swift decision-making process from a position of financial strength. Monitor the common industry metric of “age of facility” ratio to help gauge how well your organization is keeping its facilities up to date.

Can you change what is under your control?

From an operating perspective, excluding interest and depreciation, about 70 percent of operating costs are labor related in the form of full-time equivalents (FTEs) or benefits. FTEs tend to be the hardest to reduce when economic challenges arise and easiest to increase when times are good. Evaluate the following areas for indications of looming financial challenges:

- Price differentiation — Can you price appropriately in the marketplace to offset cost increases?

- “Spread” management — Do you have a history of managing to even spreads or positive spreads?

- Fundraising capabilities — Do you have a history of strong fundraising to supplement operating deficits?

- Investment portfolio — Can you consistently rely on investment returns to supplement operating deficits?

Are your operating spreads positive?

The net operating margin (NOM, and EBITDA as an equivalent) can be viewed as the canary in the coal mine of predictive ratios — if it starts acting funny, you should probably pay attention!

In most ventures, NOM represents an intrinsic relationship between the funds received for providing services and the cost of providing those services. NOM has historically been viewed as the one ratio that is almost entirely within management’s day-to-day operating capabilities.

A declining NOM is usually an early indication of future financial trouble. The underlying concept of spreads is useful in determining whether operating revenues are increasing at the same rate as operating expenses. A board that oversees a history of declining NOM ratios should insist on a pathway to normalcy before approving a budget that incorporates negative spreads.

In the current environment, what is most likely to impact NOM is inflation. In a recent CLA survey, 60 senior living provider organizations shared their thoughts on how much inflation they expect over the next year.

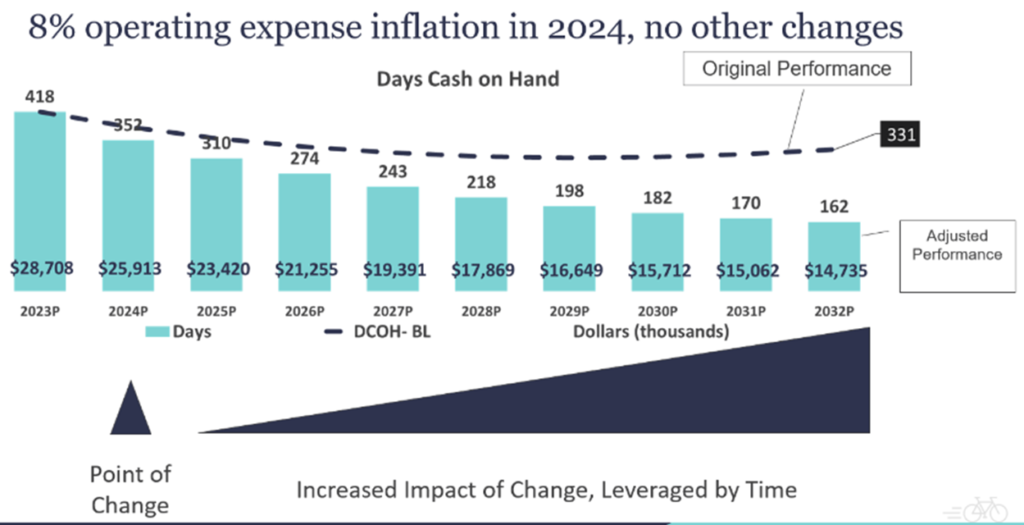

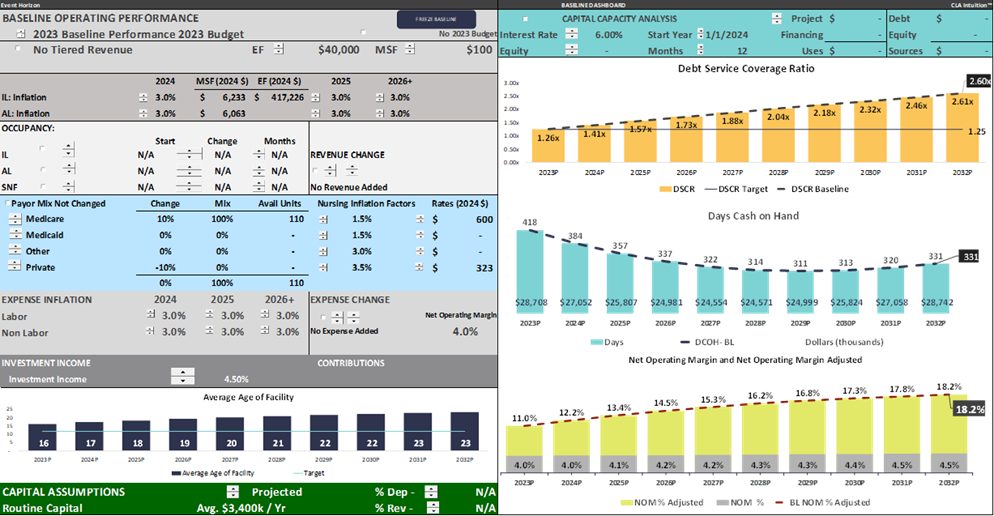

Consider this snapshot from CLA Intuition, a financial modeling tool we developed to help organizations understand the long-term implications of changes to strategies. Here, it shows the impact of spreads on financial performance. The baseline in the graphic assumes an even spread (rates 3 percent, operating expenses 3 percent).

Increasing operating costs by 8 percent without a corresponding increase in rates illustrates the long-term impact. The impact on liquidity (days cash on hand) is highly amplified by time. Those initial changes may not seem particularly challenging to absorb, but represent a decision by boards to accept a negative spread. This also happens with service creep (addition of services/staffing with no corresponding increases in fees).

A sequential series of years with similar changes can be harmful. Measure your NOM and do not allow it to erode; track and ask about your historical and current-year spreads, and evaluate the long-term impact of those changes.

Are you generating financial capacity?

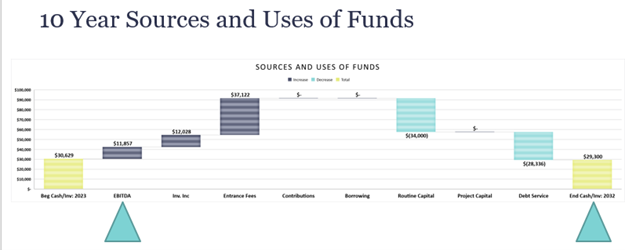

If you are not actively focused on maintaining spreads, you may be accidentally siphoning your financial strength from market repositioning needs or other strategic ventures. Consider the use of an arbitrary index that can measure your financial capacity. Building a 10-year financial model while being diligent with the budgeting process can help your board understand how your organization generates and uses funds.

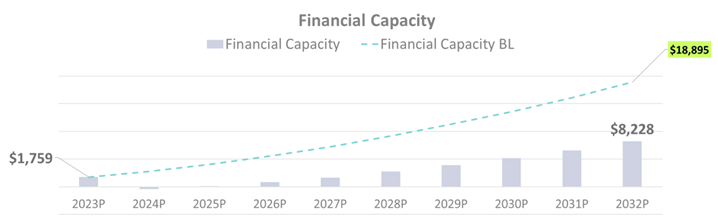

A simple way of looking at financial capacity is to measure, at any point in time, the excess cash (above your target reserves) and borrowing capacity (above a certain threshold). Consider this financial capacity graph that uses the same information for the hypothetical 8 percent cost increase.

The dotted line represents an even spread and the graph represents the 8 percent increase in costs. That change amounts to an approximate decline in financial capacity of $10 million ($18,894 versus $8,228). Measuring the impact on this index from any change to operations can help reassure boards that their strategic plans can be funded in the future.

Questions around how to increase capital capacity at the board level can generate helpful discussions focused on both operations and growth. Historically, expansions are one of the well-established ways to significantly increase capital capacity, as well as refinancing of debt when practical.

GOVERNANCE WELLNESS CHECKLIST: STRATEGIC ALIGNMENT

Is your strategic plan a strategic plan?

In the face of recent market, workforce, and other disruptors, boards are tasked with reevaluating whether their organization’s current strategic plan is relevant. Even if it’s still possible to effectively execute your organization’s strategy — should it move forward with previous strategies? It’s difficult to abandon an expansion project that once made sense, particularly if significant expenditures have been made.

Completing such a project might inevitably cost an organization more in the long term if current conditions are not evaluated. Strategy is used to transform, whereas a business plan is short-term oriented. A business plan may ask, how do we staff the nursing, while a strategic plan may ask, how do we downsize or eliminate nursing.

What insights do your board meetings and executive sessions provide?

Annual audits, for example, provide a wealth of insight for organizations, and executive sessions with those strategic allies are an added benefit of the process. Budget variances to actual analyses are also helpful sources of information.

What types of questions are you asking at board meetings? Do you find that negative variances are the norm? Are there strategies in place to contend with negative variances? Does your management team have plans but fails to implement them?

One common practice for gaining insight is known as enterprise risk management (ERM). Its core idea is that managing risk is a process. It requires direction (the board), identification of risks (all), and execution (management). Having a solid ERM plan to monitor identified risk can help build confidence and allow boards to move from an operational to a strategic mode.

Are professional competencies evolving within your organization?

The demands and expectations of an organization’s leaders have evolved — today’s environment may demand different competencies. Lack of management depth and succession plans can make your organization vulnerable.

Adapt by embracing your organization’s needs, seeking external professional education, and prioritizing professional development. If responding to market opportunities moves your organization into business lines where your current management team has little experience, your board may consider affiliations with other organizations to better improve the odds of operating in a complex environment.

For more information, contact Mario Mckenzie at mario.mckenzie@CLAconnect.com or 704-491-5534 or Raquel Castro at raquel.castro@CLAconnect.com or 714-795-5457.

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting, investment, or tax advice or opinion provided by CliftonLarsonAllen LLP (CliftonLarsonAllen) to the reader. For more information, visit CLAconnect.com